Snow Contracts and Expectations

Winter in Minnesota is quickly approaching! When the white stuff starts to fall, it’s important to understand how specifications in snow contracts will affect when snow is removed from your roadways, driveways and sidewalks. Just like snowflakes, every snow contract is unique. To better understand the nuances of your contract, check with your Board or contact Sharper Management. We are happy to share this information with you. While unique, there are some common specifications of a snow removal contract. Some of these specifications are: Trigger Depth – Your contract likely states an accumulation total that must be met before snow service will commence. This can be anywhere from a trace up to multiple inches. For most, it is somewhere between 1 – 2 inches. This can be one of the biggest variables in the pricing of your snow contract and the definition of “trigger depth” is important. Does your contract state that service will happen when the trigger depth has been met for a single snow event/storm, or is it vague regarding at what point trigger depth is met? There is a significant difference between the definitions. For example, you could have a winter where less than 1 inch of snow accumulates per event, but there may be many events like this in a relatively short period of days thus creating heavily packed drives in your association. Most contracts are written “by event”. Timing – The second most important component of your contract is the time in which snow service must be completed. For most contracts, “final cleanup” is somewhere between 6 – 12 hours after the snow has stopped falling. This timeline is also subject to snow accumulation totals. The more snow received, the more time allowed for cleanup. Open-Ups – Most contracts provide for an open-up during snowfall events that exceed a particular total. For example, if 4 -6 inches of snow depth is met, but the event has not stopped, it is common for an open up to happen. Open-ups are simply done to allow vehicles to come in and out of the community. They are not the same as a final clean up and generally consist of a single pass through the roadways with the plow. One thing to define in your snow contract is whether open-ups include driveways, or just main roadways. Typical language states that an open-up will occur prior to __AM and/or after __PM. Then the final cleanup will occur per the contract as discussed in the “timing” section above. We realize that snow is inevitable and, while often beautiful, can create some frustrations. Knowing a bit more about how your snow contract is written may alleviate some of these frustrations over the coming months. Stay safe this winter!

Sharper Management Supports Community Organization Open Arms

Giving back to our community is one of Sharper Management’s most important core values. Each year we choose local charitable organizations to support – it’s just the right thing to do. This year as part of the Sharper Open, an annual golf tournament held in July, we incorporated a charitable component. Recently, our Accounting Manager Todd Essig, delivered the proceeds from that event to Open Arms. Open Arms is a nonprofit that cooks and delivers free, nutritious meals to people living with life-threatening illnesses in the Twin Cities. Donations such as our helps Open Arms and their more than 7,600 volunteers deliver 624,000 meal to neighbors in need each year. “We’re so happy to be able to give back to our community in this way,” states Partner and Chief Operating Officer Matt Froelich. “The work of Open Arms is an important way we can help care for those in need in our own backyard.” Founded in 2010, Sharper Management is a locally owned, mid-sized property management company offering a full suite of premiere services to homeowner’s associations of all sizes. Sharper Management currently provides services to the Minneapolis-St. Paul, MN seven-county metro area. For more information on Sharper Management services and employment opportunities, call 952-224-4777 or send an email to info@sharpermanagement.com.

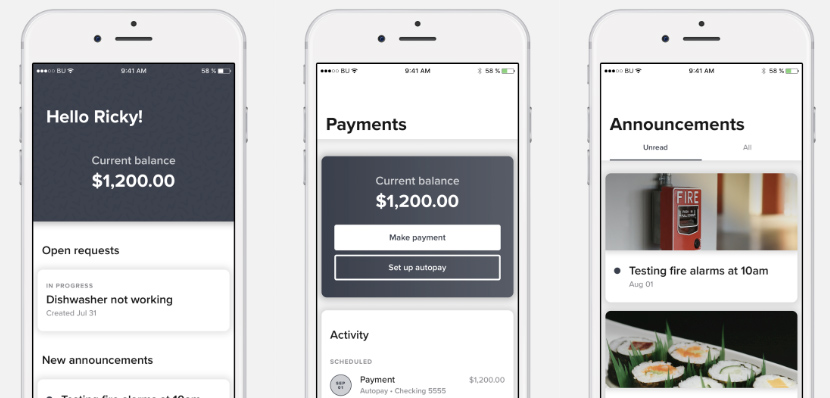

Announcing the New Resident Center App

Sharper Management is excited to announce the new Resident Center mobile app powered by our software system, Buildium! A new mobile app made specifically for you and your members. Resident Center is designed with simplicity in mind. Homeowners can make payments, submit maintenance requests, contact your property manager and more–with just a few taps. The features available vary based on the permissions granted, but some of the key features are: One-time and recurring online dues payments Maintenance requests with photo attachments Announcements, texting, and other communication features Ability to provide proof of insurance coverage (when required) Access to governing documents As the Board, you are also able to access the financial reports and other documents. Be sure to check it out!

October Board Training Was a Success

Thank you to all those who attended our Fall Board Training on October 15. It was a great success. The topic was Insurance and Financial Basics. Eric Skarnes from Insurance Warehouse presented some great information on various insurance policies, coverages and market trends. Did you know that Minnesota is now considered a “catastrophic state” when it comes to wind and hail storms? The June 2017 and August 2019 storms played a big role in this categorization. What does this mean for you as a Board and for the Association? It means that premiums are on the rise, deductibles are increasing and fewer carriers are staying in or entering the association insurance market. Eric mentioned we can expect increases of 3-5% per quarter in the near term! Deductibles are typically per building (and the per building values are increasing) or based on a percentage of the property value. Typical per building deductibles are $25,000 or more, and the most predominate percentage used is 2%. Since October is Fire Prevention Month, let’s touch a bit on insurance claims due to fire. Luckily, fires are less prevalent and, therefore, not as large of a concern as far as the insurance companies are concerned. While we can expect insurance rates to rise due to cost of living increases, fire coverage is not seeing the same increases as wind and hail. Master policy deductibles for fire claims are typically $5,000 to $10,000 per occurrence, although larger associations occasionally choose higher deductibles. Our next board training, “Board Basics: An Orientation for Board Members”, is Tuesday, January 14th at 6:00 PM.Topics covered will include: * Defining Types of “Associations” * Roles & Responsibilities of the Board * Financial Fundamentals * An Overview to Governing Documents & State Statutes * How to Run Effective Board Meetings * Insurance Basics * Property Management Practices If you are interested in reserving your spot, please email info@sharpermanagement.com