Dues Increases – No Resident Wants It, But Every Association Needs It

Most Associations have a traditional calendar fiscal year (January-December), which means soon we will be entering budget season for 2023. Back to basics, your operating budget is what sets the “dues” amount that people will pay each month/quarter/year. Each Association is different in what they are responsible for funding, but operating budgets should account for all contracted services (lawn/snow, landscaping, pools, elevators, garbage, management, etc.), utility services (electricity, water/sewer, gas), maintenance issues (exterior or interior repairs), discretionary items (administrative costs, community parties, etc.), insurance, and contributing to the Reserve Fund. Looking back on 2022, there’s no doubt that there were a number of budget busters. Material costs have risen sharply due to raw material shortages over the past two years. For example, paint costs alone have gone up 30% since 2021. Your “touch up” paint job just got more expensive. Labor shortages in many of the trades has caused increased pricing for many service areas. For example, lawn/snow providers have had a hard time staffing and have begun cutting non-profitable clients or making significant adjustments to cover their increased costs in fuel, wage increases to get people to work, increased fertilizer costs, etc. And speaking of fuel costs, check your garbage hauler invoices, you may have been getting surcharges for fuel prices being over $4 per gallon. The insurance market for the multi-family/associations continues to be volatile as Minnesota remains in the top 3 in the nation for claims paid out over the past few years. Experts continue to predict a 15-30% increases for your renewals. The economy and inflation have been all over the news this summer. It’s no surprise to anyone that everything has increased in price. So, keep this in consideration when budgeting for 2023. An even more careful look at your Budget vs Actuals report is imperative as you project your 2022 year-end numbers. A detailed look at your General Ledger should help as you begin realistically budgeting for your 2023 needs to reflect the current economic realities. No one likes to hear it, but the truth is every year dues should go up. Inflation is real. Things don’t get cheaper. To stay fiscally healthy, dues should, at a minimum, go up to reflect inflation. Looking into 2023, you may want to be even more aggressive, considering our current economic climate.

Association Funds: Operating vs Reserve

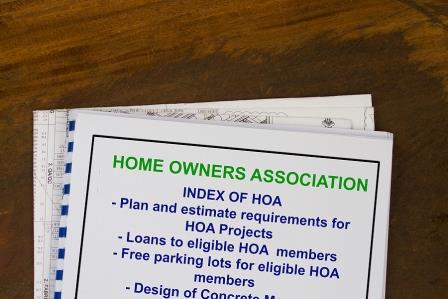

Since most associations are on a calendar fiscal year, your Board of Directors and Management will soon start working hard to establish your 2023 Operating Budget. This budget, essentially, sets your “dues” – so we thought it would be a timely opportunity to explain the difference between the “operating budget” and funds VS the “replacement reserve” schedule and funds. Operating Budget Each association varies, of course, but an overwhelming majority treats operating and reserve (or capital) funds differently. Your association works within an operating budget to pay for your necessities and recognized amenities. These items are set by your Governing Documents. Common examples include lawn care, landscaping, snow removal, insurance, management services, repairs and maintenance, association covered utilities, amenity costs for pools or other recreation, etc. These are the costs to run your association on a day-to-day basis. This budget makes up your monthly/quarterly/annual assessment – commonly called “dues.” Little known fact – for most associations, did you know that your monthly dues payment is technically called an annual assessment? The common practice is to break it up into 12 equal monthly installments and call them “dues.” But, for most associations, the adopted operating budget and your share of those expenses (be it by ownership percentage in a condo or your equally divided share of the planned community) is legally recognized as a yearly assessment. Reserve Fund The association’s reserve, or capital, fund is essentially the savings account to pay for large replacement projects such as re-roofing, re-siding, concrete and asphalt replacement, etc. Most associations work off of a professionally developed Reserve Study that lays out the plan for which components should be replaced which year, and a funding plan to pay for those replacements. So, how do these funds work together? The reserve fund is contributed to via an expense listed in the operating budget. If the Reserve Study says in 2023 the association should contribute $120,000 to the Reserve Fund, typically each month the association will take $10,000 generated from your dues revenue and deposit into the Reserve Fund account. This is a set line item in the operating budget. It’s a lot like a savings and checking account. You deposit your paycheck into your checking account, which you use to pay your regular bills. It’s your “operating account.” You might also plan an amount each month you send to your savings or retirement account to pay for those big expenses down the road. It’s your “reserve account.” Hopefully this helps to explain two very different funds your association is working with!

Reviewing Your Dues

Goods and services go up over time. Doing an annual maintenance plan and having a reserve study done every few years will help your board understand what should be charged for dues each month to adequately fund your HOA. The other part of the equation is accounting for inflation of goods and services year-over-year. Opening the conversation to assess your dues can be very helpful for boards so special assessments can be avoided. Rising interest rates. No matter what we do, we can’t escape rising prices. As prices increase and dues stay the same rate, your spending will become unsustainable. Even if you have a modest budget, you can never tell when an emergency could occur that forces you to use up any extra money you had. Ease of payment. Doing small but steady price increases will be much easier on HOA members’ wallets than sudden price jumps every few years. Small increases normally have less backlash and are easier for homeowners to budget around than large, irregular increases. Larger increases are also more likely to go unpaid, reducing your budget even further. Caps on annual increases. In most association’s governing documents, there is a maximum percentage that you can increase your dues every year. When you try to catch up with a large due increase, the cap percentage may not be large enough leaving your HOA to run at a deficit until you can increase prices again next year.