Summer Living in an HOA – The Pool

Living in Minnesota we know all too well how much our temperatures swing between summer to winter. We go from one cold extreme to a very hot extreme within a few short months. That makes having a pool in your HOA very attractive in the summertime. It’s important to keep in mind some of the most basic pool safety tips while enjoying our beautiful warm weather. Every HOA will have their own set of rules to be aware of, but the common ones we see most often include: No pushing, running, or excessive horseplay in the pool area. Pools decks can be slippery. No swimming under the influence. No glass in the pool area. No swimming during a rain or thunderstorm. Lifeguards are not on duty in a HOA pool. It is swim at your own risk which means you and the children the accompany you. Please be sure closely watch children while they are in the pool. Young children who are not fully potty trained must wear swim diapers to avoid contamination of the pool. Be reasonable about the amount of noise you and your family are making while in the pool common area. Teach children basic water safety tips and enroll them in swimming lessons. Keep children away from pool drains, pipes, and other openings to avoid entrapments. Don’t rely on fun toys such as water wings or noodles to keep your children safe. If your child can’t swim, fit them with an appropriate personal floatation device (PFD). Learn how to swim and teach your child how to swim.

Summer Storms

We’ve already experienced some of the fury Mother Nature can produce this summer season resulting in widespread hail damage to roofs and siding in the south metro. We thought this would be a great time to share a few tidbits regarding insurance coverages and what to do in the event of server weather. If you’ve grown up in the Midwest, you’re already adept at being “sky aware” on sticky, hot, humid days. Our modern lives and cell phone make getting weather updates and notifications easier than ever to stay current on your local weather conditions. But, do you know what the alerts mean? Watches – The conditions are favorable or expected but not occurring or imminent. Tornado Watch – Atmospheric conditions are favorable for the development of severe thunderstorms capable of producing tornados. Severe Thunderstorm Watches – Atmospheric conditions are favorable for the development of severe thunderstorms capable of producing hail at least 1″ in diameter and/or 50 know (58 mph) or great wind speeds. Warnings – A tornado is occurring or is imminent for the warning area. Tornado Warning – A severe thunderstorm has developed and has either produced a tornado or radar has indicated intense low-level rotation in the presence of atmospheric conditions conducive to tornado development and/or a human has spotted a tornado. Severe Thunderstorm Warning – A severe thunderstorm has developed and is capable of producing hail greater than 1″ in diameter and/or 50knot (58 mph) wind speeds. Seeking Shelter – Suggestions from the National Weather Service If you are at home during a tornado: Go to a windowless interior room on lowest level of your house. Go to a storm cellar or basement if your house has one. If there is no basement, go to an inner hallway or a smaller inner room without windows, such as a bathroom or closet. Get away from the windows. Go to the center of the room. Stay away from corners because they tend to attract debris. Bring your pets with you if time allows. After the Storm Emergency Response What to do if damage occurs during non-business hours? The Sharper Management team has a 24/7 emergency line in place just for situations like this. We are in touch with our own maintenance teams and vetted contractors who will respond to triage the situation to prevent further damage. Repair Responsibility? Your governing documents will explain who is responsible for repairs to exterior damage. Common roofs and generally items that are “studs out” are covered by the insurance policy of the HOA. That would include exterior items such as a damaged roof, siding, gutters, and windows. If a tree, for example, crashes into your condo complex and damages the roof and breaks windows, the “studs out” clause would put responsibility in the court of the HOA. However, if the fallen tree creates a hole in the roof and your unit floods, this damage is “studs in” and your homeowner’s policy would come into play. Again, it’s best to check your association’s documents for the details. If you find your individual home policy needs updating, now is a good time to do this. Let’s all hope for calm weather in August!

Summer Living in an HOA – Nuisance Barking

As summer approaches, it’s inevitable that noise complaints in many forms will arise within an HOA. One of the most common issues is barking dogs. The definition of nuisance barking varies from one association to the next, and some City Ordinances, but examples of common definitions include: Nuisance noise from a dog is defined as barking, yelping or whining for more than 5 minutes in any 1-hour period. Excessive barking is barking that is persistent and occurs for an extended period-of-time or on a repeated basis. When determining if barking is a violation, consideration will be given to the time of day, duration and frequency of barking. No animal shall be allowed to annoy residents unreasonably, to endanger the life or health of other animals or persons, or to substantially interfere with the quiet enjoyment of others. Pet owners shall be deemed in violation if their pets: Consistently or constantly make excessive noise; Cause damage to or destruction of another’s property; Cause unsanitary, dangerous or offensive conditions, including the fouling of the air by offensive odor emanating from excessive excrement; or Create a pest, parasite or scavenger control problem which is not effectively treated. Most HOA’s will require a formal complaint in order to taken action regarding issues such as nuisance barking. Checking your association’s rules and regulations around is the first step to take. It is also to important to understand that the subjectivity of the terms “nuisance” and “excessive” can put the association in a difficult position. Homeowners need to be aware that most cities have pet ordinances and that avenue is also a means for remedy of persistent or subjective pet issues.

How Associations Work – Sharper Management’s Role – A Closer Look

We often are asked about services homeowners perceive to be the responsibility of the management company. In actuality, contracts vary from one HOA to another depending upon the HOA’s budgets and needs. The duties of the management company will be outlined in the Management Agreement and often involve both administrative and site management services, but not always. Depending on the needs of the association, you may have a financial only contract with your management company, or a contract by which outside contractors manage the association’s grounds. Financial-only With a financial-only arrangement Management of the reserve fund (savings account) Accounts payable Budget prep Tax prep Dues and collections management Resale disclosures Full-service With a full-service arrangement some of the typical items the management company is responsible for include are; Property inspections (frequency determine by contract) Contractor bidding and supervision Policy/rule enforcement Correspondence Dedicated community manager (onsite or offsite as per individual HOA needs and contract) Meetings Handyman services 24/7 emergency services Full-compliment of financial services (as noted above in financial-only list) Each HOA determines the level of service they would like to receive and contracts with the management company and the associated fees for services are dictated by the contract.

Getting Ready to Sell in an HOA

Prepping for the sale of your home doesn’t need to be an arduous task. Just like selling any other single-family home, selling your townhouse or condo may require a few interior updates and fixes, but there are also a few simple things that you can do that will go a long way in adding appeal to your property. Simple Tips for Selling Clean and re-organize your space – As long as you’re trying to sell your CIC property, you will need to keep it clean and organized in case of any last-minute showings. Rooms should be re-arranged to appear spacious, and storage areas should be emptied, when possible, to make them appear larger. Depersonalize your space – Take down or remove items such are your photos on the wall, religious items, knickknacks, worn-down furniture, and other personal items. Potential buyers want to envision themselves in the space, and a non-personalized space can help them do that. Little updates go a long way – Updating things like cabinet hardware or outlet covers will help the space feel updated without a lot of effort. If your walls aren’t already neutral colors, then re-paint them so they’ll appeal to a wide range of buyers. In general, a new coat of paint will make a space look better. Focus on your kitchen and bathroom – The kitchen and bathroom are big sellers in any home. Make sure they are clean! If your bathtub has mold in the grout, scrub it or reroute the lines to freshen them. Remove clutter from your kitchen countertop space. This will make even a small kitchen seem larger. Be flexible with your showings – Stay courteous and responsive when dealing with potential buyers. Flexibility when setting up a showing will help move you to sale faster. Choose the right realtor – Make sure you choose a realtor who knows how to market an HOA property. Ask questions about where they plan to market your home. Does include a full range of the most popular real estate websites such as Realtor.com? Will they bring in a professional photographer to ensure your online photos make your home look its very best? With these helpful tips, you should be able to expertly present your property to potential buyers. Remember to also play up the benefits of your HOA. As the seller, you’ll need to provide resale documents to your potential buyer. You can find this information on our website. Visit sharpermanagement.com and look for the Resale Disclosures link in the menu bar. Or, click here.

How Associations Work – Sharper Management’s Role

While the elected board of a CIC, or Common Interest Community, operates on behalf of preserving their community, they will most likely hire a management company to aid them in the day-to-day duties. The management company will act under the board’s orders and takes direction from them on how to manage the association under their specific regulations. In some cases, the management company will also assist with the budget process, prepare board meetings, and serve as a consultant in the event of issues in the association’s community. Essentially, management companies are there to make it easier for the board to uphold their community’s standards and investment in their homes. Our role as a management company to many association communities includes helping the board in their administrative, maintenance, and communication duties. Our high-quality service revolves around a culture of communication, teamwork, and growth; we show this through our typical services, which we further outline on our website. In general, our team helps the board manage the maintenance of the community, staffing a 24-hour emergency phone line and help facilitating emergency services, providing and maintaining a web portal that all homeowner and board members can utilize, taking care of all aspects of the financial management of the association, help facilitating various needs or questions from homeowners within the association, and so much more. Our services may differ slightly by type of CIC we are managing, but we follow our overarching values as a locally-owned company dedicated to supporting our partnered associations. We help protect each association member’s investment in a home by preserving the property and streamlining communication between unit owners and the board, the most important relationship in a Common Interest Community. We are proud to be managing the properties you call home, and look forward to continuing to support all members of the association.

Understanding Your Governing Documents

After joining a CIC, or Common Interest Community, each member receives governing documents they must follow in respect to how the community and individual units are operated and used. In most cases, governing documents include a declaration, bylaws, articles of incorporation, and rules and regulations. Those documents will describe important administration or financial info like the association’s rights and responsibilities, the homeowner’s rights and responsibilities, how the annual budget is created, and the procedure to follow when electing a board. Most importantly, the governing documents will also outline the powers granted to that elected board, which exists to help operate and preserve the association. The board will typically have the power to create or amend rules and regulations in the CIC, create procedures and parameters for fining when owners are not compliant, adopt an operating budget (which sets “dues”), hire vendors to provide services to the association, etc. Additionally, if damages or other issues occur on association property, the governing documents disclose the insurance coverage of the CIC and how the responsibility between the association and unit owner differ. In many cases, documents may define that anything outside an individual unit becomes a responsibility of the association, while maintaining and repairing damage inside the unit boundaries becomes a responsibility of the unit owner. It’s important to understand that distinction while owning the unit, which the governing documents and board will uphold. When a homeowner decides to sell their unit, the governing documents will most likely include regulations to follow during that process. In Minnesota, under the Minnesota Common Interest Ownership Act, the seller of a unit must provide the governing documents to a prospective buyer to view before purchasing. In every step of the association member’s ownership, the governing documents are necessary to read and learn in order to understand the operation of their Common Interest Community.

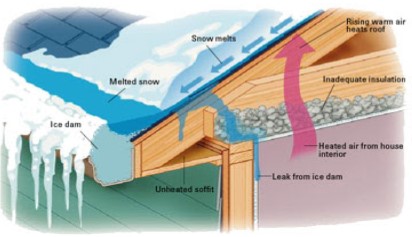

Construction Chat: Navigating a Bad Ice Dam Year

The up and down temperatures and the record-breaking February snow totals have been the perfect recipe for ice dam formation on various types of roofs this year. Ice dams are particularly tricky for associations because the line between Homeowner vs. Association responsibility can become rather blurred. First, it is important to understand how and why ice dams form. In short, they form when snow melts on your roof and then re-freezes over the eave-typically over the soffit area. The ice “dam” then prohibits further melting snow to drain properly off the roof, which can (but not always) cause leaking water into the home. There are many factors as to why ice dams form-the inevitable freeze/thaw cycle; excess snow pack; clogged gutters or frozen downspouts-but the primary culprit is excessive heat loss from the unit and/or a lack of ventilation. Which is why, many times and depending on your governing documents, ice dams and the leakage they can cause are not necessarily the association’s responsibility. They are not caused by roofing deficiencies; they are caused by insulation and ventilation deficiencies INSIDE of the home. It is important to understand how your association’s governing documents define “unit boundaries.” Does the boundary of the unit include “unfinished surfaces” or “no upper or lower boundaries”? If so, this could imply that the attic space (or the space between the roof deck and the ceiling) and insulation inside of it would be a homeowner responsibility; therefore, the heat loss causing the ice dam is the homeowner’s deal. Once there is an understanding of who is responsible for what, it is very helpful for associations to review their ice dam situation and have a policy in place for how they are to be addressed.

Winter in Minnesota

Now that we’re in February, Minnesota’s winter is roughly halfway over. Whether you love the cold or hate it, it is part of everyday life in the northland. If you’ve recently downsized into a smaller townhouse or condo, you might be dealing with a worse case of cabin fever than normal. To help cheer you up, here are some fun ways to get through the rest of winter Stay Active While it might not look like it, there are tons of fun outdoor activities that you can enjoy in the winter. For the thrill seekers, Afton Alps has skiing, snowboarding, and downhill tubing. If you like to run, visit Theodore Wirth Park at 1301 Theodore Wirth Parkway, Golden Valley, MN. Located just 10 minutes from downtown Minneapolis, this expensive park has miles of trails ranging from flat and paved to steep and winding; it is perfect for every type of runner. Theodore Wirth Park is also pet-friendly, so your favorite pup can get in some exercise too. While helping your pet get exercise during the winter can be challenging, there are a multitude of pet-friendly parks in the area. Also, remember to pick up after your dog. While no one likes to be out in the cold for longer than necessary, parks and the common areas of your association are used by all. Get Organized While a single-family home has room for anything and everything, condos and townhomes traditionally have less square footage. Especially around the holidays when people are getting gifts and buying sale items, it is very easy for the clutter to build up. One way to help stay on top of it and keep from being buried in a pile of stuff is to stay organized. For some great tips, check out this blog entry we did called “Simplify Your Space.” https://sharpermanagement.com/2017/04/simplify-your-space/ Taking a Vacation? A vacation to somewhere warm is always a nice change. If you do decide to leave town for a while, remember these important tips: Always leave your heat ON, set no lower than 55 degrees. Inform your management and neighbors that you will be leaving, and give someone emergency contact information and/or instructions to get into your unit in case of an emergency. Contact us about doing winter maintenance checks if you’re planning to be gone for an extended period of time. We hope these tips will help make the rest of your winter more enjoyable.

Insurance: So Why Does the Association Have to File a Claim?

There are few things trickier and more complicated in the operation of a community association than that of insurance. What types of policies must the association have? What is the scope of coverage? How does the “master policy” work with the individual homeowner’s policy (“HO6”)? There are many components and questions. Perhaps the most seldom understood, and sometimes hotly debated, topic on insurance is when and why the association must file a claim on the master policy. In scenarios of massive losses like a hail storm, tornado or fire – or in cases where damage is limited to common areas such as a condo building hallway or a party room – it is pretty clear that the master policy should kick in and cover damages. But what about when a townhome wasn’t properly winterized and pipes freeze? Or what about the resident on the top floor of the condo building that let the bathtub overflow, flooding the units below, and causing tens of thousands of dollars of damage? Many Boards don’t understand why the association’s master policy would cover such losses where there is perceived negligence and/or the damage is inside of a unit, and therefore “not the associations responsibility.” It’s a natural reaction. While the scope of coverage from association to association will vary, it is pretty common that the governing documents are going to require the master policy covers “the replacement costs of the building AND units.” In fact, if the association falls under the Minnesota Common Interest Ownership Act (“MCIOA” or 515B), state statute requires that the master policy covers the “total amount of not less than full insurable replacement cost of the insured property.” It goes on to say “in the case of a common interest community that contains units, or structures within units, sharing or having continuous walls, siding or roofs, the insurance maintained under subsections (a) (1) shall include those units, or structures within those units, and the common elements.” What does this language mean? It means coverage is extended far beyond what many might expect the master policy to cover. Unless the association’s documents say otherwise, the policy might not cover finishing items such as carpeting, wall paper, or paint; but the subflooring, sheetrock, ceiling, framing, insulation is, in fact, insured by the master policy. Should there be a loss (such as those frozen pipes that burst in a townhome or the units affected in that condo building bathtub overflow) AND THAT LOSS EXCEEDS THE MASTER POLICY DEDUCTIBLE, there IS coverage for that loss. You may be asking; “Why should the association’s policy cover it?” There is a very simple answer. By state statute, the master insurance policy is PRIMARY. 515B states “(4) if at the time of loss under the policy there is other insurance in the name of a unit owner covering the same property covered by the policy, the association’s policy is primary insurance.” You can read the entire statute on insurance here – https://www.revisor.mn.gov/statutes/cite/515B.3-113 The association does not get to decide what is and isn’t “coverable.” Additionally, the association doesn’t get to decide and assign “negligence.” If there is a loss and damages exceed the master policy’s deductible, a claim should be filed and coverage should be awarded per the governing documents. Insurance agents know the game. If there is a loss, the homeowner’s HO6 agent/policy is going to ask the question – how much damage? If more than the deductible, they know the master policy has to kick in and the HO6 will cover the owner’s personal property, non-covered items such as finish work like carpet, wallpaper and structural coverage up to the deductible. What the association does get to decide is how the deductible should be handled. It can be absorbed as a common expense, or, more advisably, can be assessed against the owner(s) responsible or those that are benefiting. However, that’s an entirely different newsletter article. At the end of the day, the role of a master policy to the association, and the fiduciary duty of the Board to the members of the association, is to protect property values. Master insurance policies, state statutes and governing documents put in place comprehensive insurance requirements to ensure that property losses are handled and property conditions restored – thereby maintaining property values.